Tax Increase for SA’s Top Earners. View Simple Breakdown of Budget Speech 2017

CAPE TOWN – Finance Minister Pravin Gordhan has proposed a new personal income tax bracket for those earning salaries of above R1.5 million. In tabling his Budget Speech 2017, in the National Assembly on Wednesday, Gordhan basically said “those who earn more must pay more”. The Minister has also proposed an increase in the dividend withholding […]

CAPE TOWN – Finance Minister Pravin Gordhan has proposed a new personal income tax bracket for those earning salaries of above R1.5 million. In tabling his Budget Speech 2017, in the National Assembly on Wednesday, Gordhan basically said “those who earn more must pay more”.

The Minister has also proposed an increase in the dividend withholding tax rate from 15% to 20%.

The proposal is set to affect 100,000 taxpayers.

He said the National Treasury proposes “a new top personal income tax rate of 45% for those with taxable incomes above R1.5 million”. This is comparable to several countries abroad.

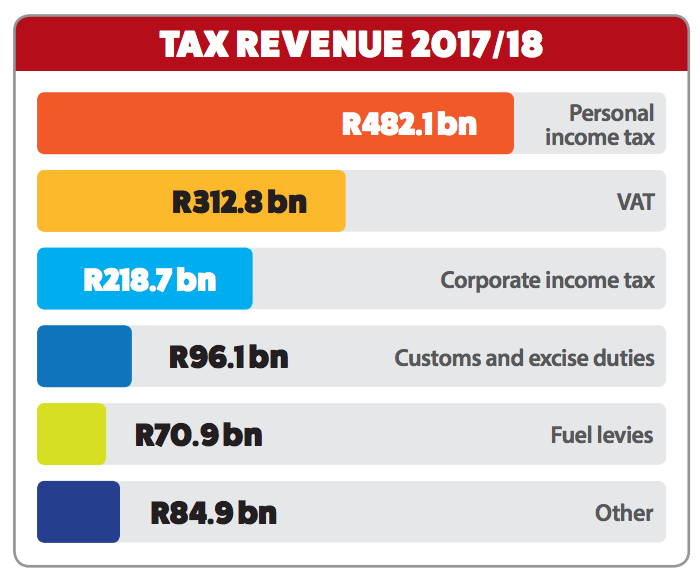

The Minister said this as the National Treasury projects a R30.4 billion shortfall in tax revenue collections for the 2016/17 financial year – the largest shortfall since the 2009/10 financial year which “reflects slower growth in wages, employment and bonus pay-outs last year, amongst other factors”.

National Treasury said in its Budget Review that although raising revenue is the primary objective of the tax system, tax is an important instrument to address inequality.

Citing studies by the International Monetary Fund, National Treasury said countries with lower levels of inequality experience higher, more prolonged periods of economic growth.

He said: “Government will monitor how the tax rate changes affect taxpayer behaviour, revenues collected and economic growth to ensure that government’s ability to reduce poverty and inequality and promote development is not diminished.”

Simple Breakdown of South Africa’s Budget Speech 2017

Tax Proposals for 2017 / 2018:

- A new top marginal income tax bracket for individuals combined with partial relief for bracket creep will raise an additional R16.5 billion.

- R6.8 billion will be collected through a higher dividend withholding tax rate. Increases in fuel taxes and alcohol and tobacco excise duties will together increase revenue by R5.1 billion.

- As soon as the necessary legislation is approved, government will implement a tax on sugary beverages.

- A revised Carbon Tax Bill will be published for public consultation and tabling in Parliament by mid-2017.

Spending Programmes:

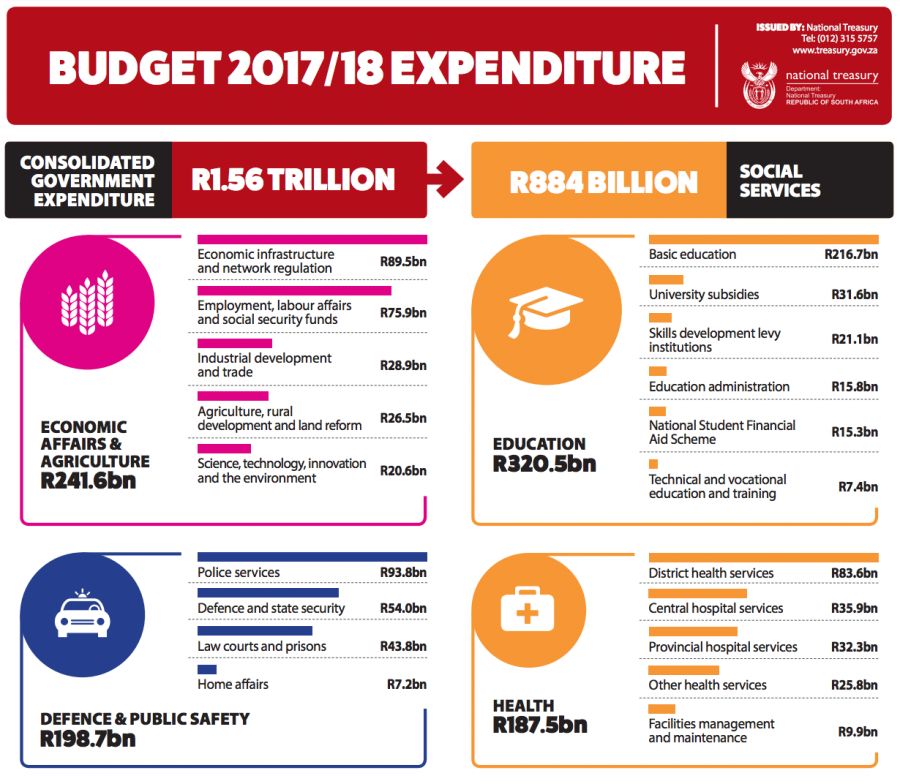

Over the next three years, government will spend:

- R490.4 billion on social grants. R105.9 billion on transfers to universities, while the National Student Financial Aid Scheme will spend R54.3 billion.

- R751.9 billion on basic education, including R48.3 billion for direct subsidies to schools, R42.9 billion for infrastructure, and R12.7 billion for learner and teacher support materials. (Minister Gordhan announced that over and above the R32 billion that was allocated to higher education last year, funds have been provided to ensure that students from households that earn up to R600,000 do not pay university fee increases for 2017.)

- R114.8 billion on subsidised public housing.

- R94.4 billion on water resources and bulk infrastructure.

- R189 billion on transfers of the local government equitable share to provide basic services to poor households.

- R142.6 billion to support affordable public transport.

- R606 billion on health, with R59.5 billion on the HIV/AIDS conditional grant.

Budget Framework

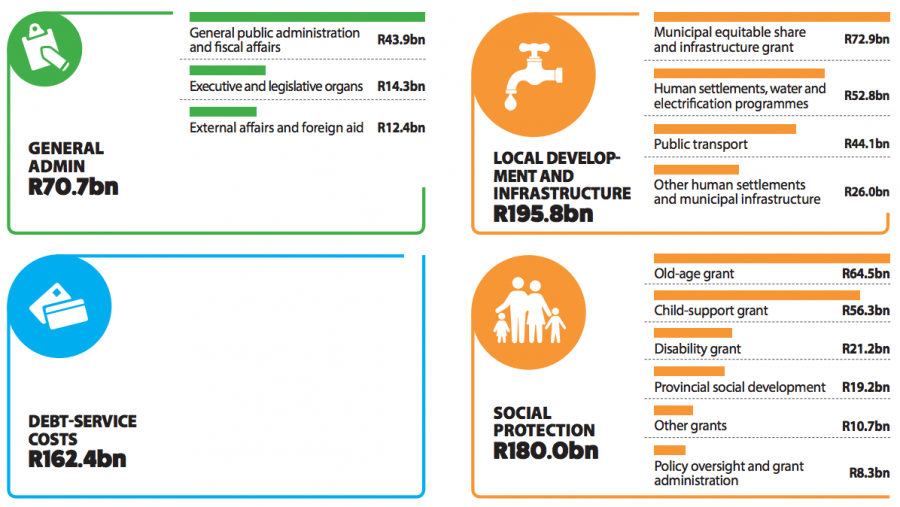

- A budget deficit of 3.4 per cent of GDP is expected for 2016/17, narrowing to 2.6 per cent in 2019/20.

- Debt stock as a percentage of GDP is expected to stabilise at 48.2 per cent in 2020/21.

- The main budget non-interest expenditure ceiling has been lowered by R26 billion over the next two years.

- R28 billion in additional tax revenue will be raised in 2017/18. Measures to increase revenue by a proposed R15 billion in 2018/19 will be outlined in the 2018 Budget.

- R30 billion has been reprioritised through the budget process to ensure that core social expenditure is protected.

- Real growth in non-interest spending will average 1.9 per cent over the next three years. Apart from debt-service costs, post-school education is the fastest-growing category, followed by health and social protection.

The Full Budget Speech 2017

The Full Budget Speech 2017

Minister Gordhan says the main tax proposals are: #Budget2017 pic.twitter.com/JGFSJdsBzq

— South African Government (@GovernmentZA) February 22, 2017