South African Reserve Bank Row Exposes ANC Divisions

JOHANNESBURG – A row centring on the South African central bank – the Reserve Bank – exposed deep divisions in the governing ANC party on Wednesday, as a faction loyal to President Cyril Ramaphosa opposed calls from a rival group for the bank to do more to boost employment and growth. The dispute between a […]

JOHANNESBURG – A row centring on the South African central bank – the Reserve Bank – exposed deep divisions in the governing ANC party on Wednesday, as a faction loyal to President Cyril Ramaphosa opposed calls from a rival group for the bank to do more to boost employment and growth.

The dispute between a disparate group of leftists and populists in the African National Congress (ANC) and Ramaphosa’s more moderate allies has shaken confidence in South Africa, which saw its steepest contraction in a decade in the first quarter.

The longer the economy stays in a rut, some analysts say, the harder it will be for Ramaphosa’s faction to resist calls for the Reserve Bank to take a more active role in trying to rekindle growth.

The row flared up on Tuesday when ANC Secretary General Ace Magashule said an agreement to expand the central bank’s mandate “to include growth and employment” had been sealed at a three-day party meeting with partners such as labour unions.

Investors are worried that expanding the central bank’s mandate beyond inflation-targeting could erode its independence and increase arguments for riskier monetary policy.

There is also a danger that Ramaphosa could get bogged down in internecine party battles over the central bank that could distract him from his reformist agenda. Those fears have caused the rand to fall and its volatility to spike.

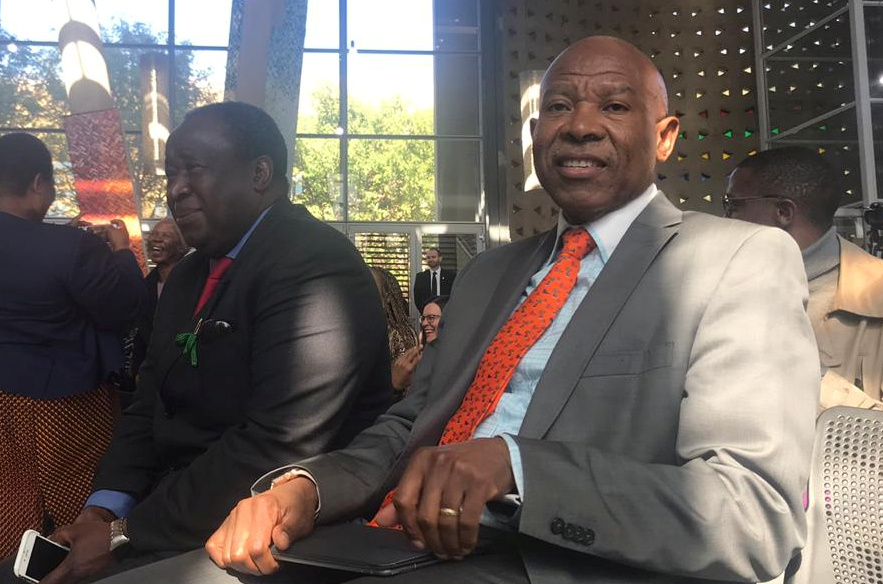

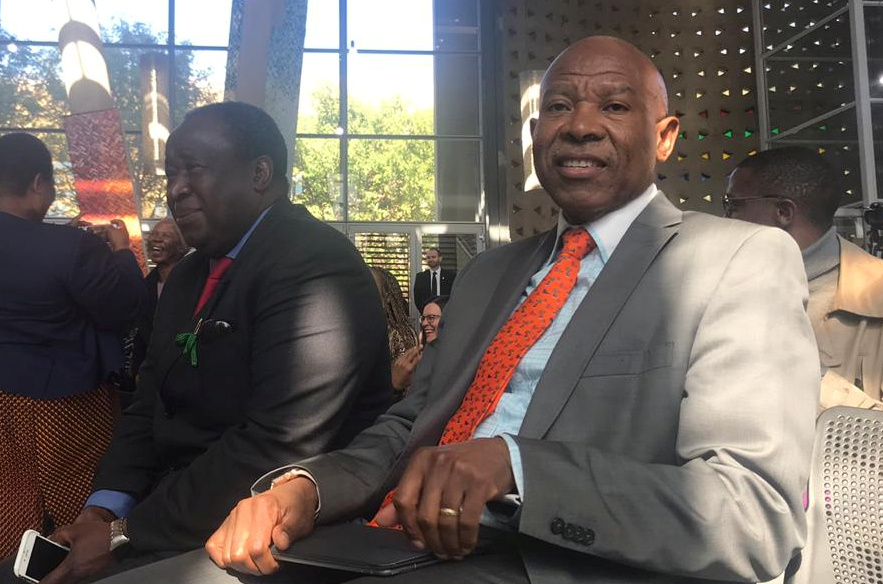

South African Reserve Bank (SARB) Governor Lesetja Kganyago said on Wednesday that the bank’s focus on price stability was enshrined in the constitution and that it had limited capacity to increase employment.

“What you can’t do is to beat up an economy that is already on its knees and simply believe that by beating it harder it will produce jobs,” Kganyago told reporters.

He dismissed other comments by Magashule on Tuesday that the ANC wanted to explore quantitative easing as not appropriate for South Africa’s economic realities.

Ramaphosa has not yet commented on the dispute, and his spokesperson did not answer phone calls.

DISPUTED MEETING

ANC spokesman Pule Mabe said on Wednesday the governing party was standing by Magashule’s remarks.

He was contradicted by Finance Minister Tito Mboweni, a close Ramaphosa ally, who said on Wednesday that no agreement to expand the bank’s role had been agreed at the three-day ANC meeting known as a lekgotla.

Other Ramaphosa supporters said the lekgotla, a consultative meeting, did not have the authority to take such an important decision.

“There was a suggestion from someone at the lekgotla that the role of the central bank should be expanded, but it was just a suggestion. The lekgotla cannot change policy,” ANC veteran Snuki Zikalala, who attended the gathering, told Reuters.

But another ANC official at the meeting, who did not wish to be named, said there had been serious debate there about expanding the central bank’s role and that he supported the move.

Those calling for a broader central bank mandate were emboldened by the 3.2% economic contraction in the first three months of the year, as well as stubbornly high unemployment of around 27 percent.

(Additional reporting by Nqobile Dludla and Marc Jones; Editing by Hugh Lawson)