SARB Should Look Into Allegations Surrounding Capitec Bank

The allegations made by US-based company Viceroy Research that South Africa’s Capitec Bank is operating as a loan shark – and which Capitec have dismissed as factually incorrect – are serious and should be investigated by the SARB (South African Reserve Bank), says David Maynier, DA Shadow Minister of Finance. Viceroy released a report on […]

The allegations made by US-based company Viceroy Research that South Africa’s Capitec Bank is operating as a loan shark – and which Capitec have dismissed as factually incorrect – are serious and should be investigated by the SARB (South African Reserve Bank), says David Maynier, DA Shadow Minister of Finance.

Viceroy released a report on Capitec, staying: “Based on our research and due diligence, we believe that Capitec is a loan shark with massively understated defaults masquerading as a community microfinance provider.”

Furthermore, the report called on SARB and the Finance Minister to place Capitec under curatorship.

The SARB said it had noted the Capitec report and that “according to all the information available, Capitec is solvent, well capitalised and has adequate liquidity. The bank meets all prudential requirements.”

Maynier stressed on Tuesday: “We have to be absolutely certain that there is no risk to depositors and that the banking system is safe and sound in South Africa.”

SARB said as part of its mandate, it monitors the safety and soundness of all banks, including Capitec Bank Limited (Capitec).

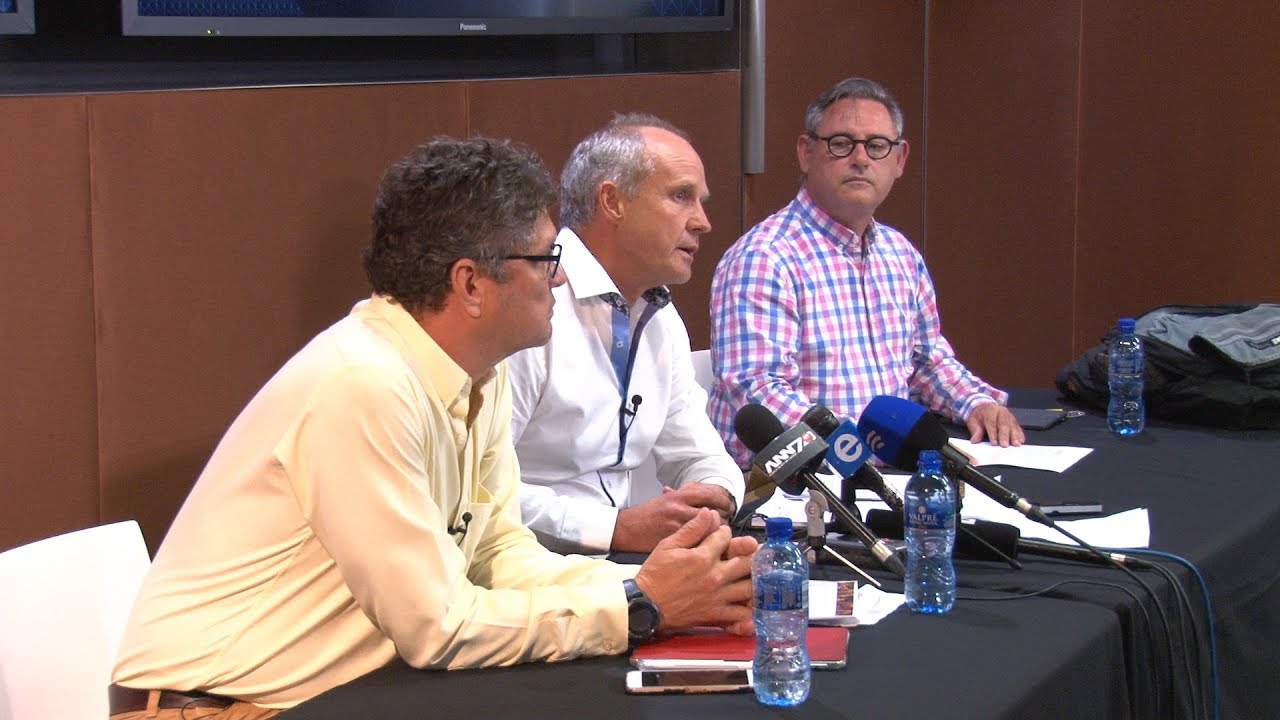

Capitec held a press briefing, stating: “We want to reassure our customers that we are open for business and we welcome the statement from the Reserve Bank that we are solvent with adequate liquidity. Capitec Bank remains committed to transparency and full disclosure.”