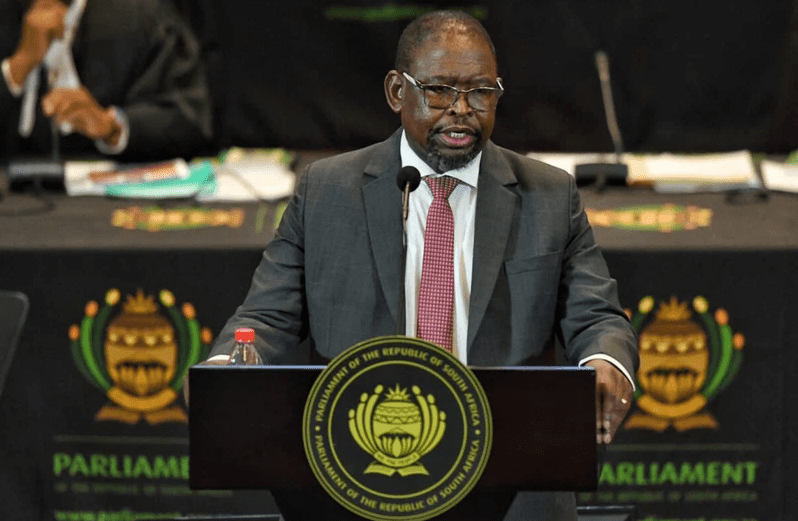

Midterm Budget Speech 2023: The good and bad – Godongwana’s address summarised

The nations economy grew by 0,9% despite record levels of load shedding, according to Finance Minister Enoch Godongwana.

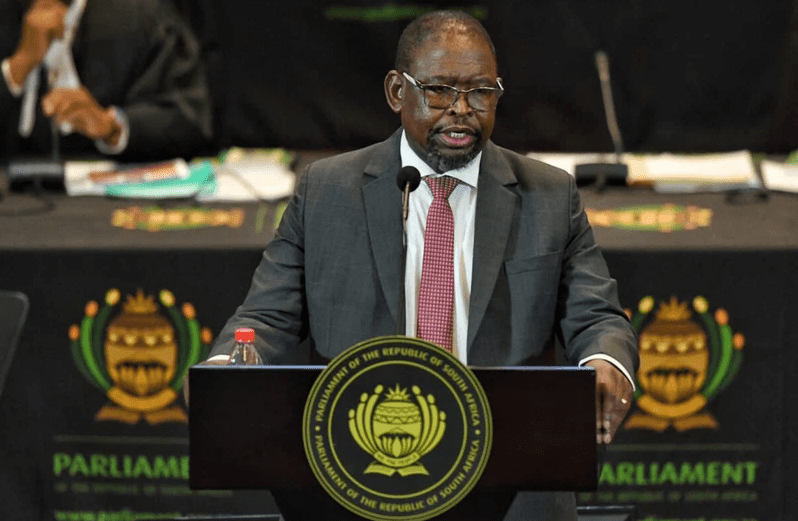

Finance minister Enoch Godongwana delivered his Midterm Budget Policy Statement in Parliament this afternoon.

In his speech Godongwana unfortunately had no good news in terms of the country’s mid-term economic oulook.

ALSO READ: Austerity TIME: Worsening budget deficit confirmed in MTBPS

“The economic outlook over the medium term remains weak, reflecting the cumulative effect of power cuts, the poor performance of the logistics sector, high inflation, rising borrowing costs, and a weaker global environment”, the Minister says.

FISCAL OUTLOOK- GOVERNMENT DEBT

Godongwana has revealed that the government government spending continues to exceeded its revenue since the 2008 global financial crisis.

“Rising annual budget deficits have reached an extent where the government will borrow an average of R553 billion per year over the medium term.”

As a result, gross debt rises from R4.8 trillion in 2023/24 to R5.2 trillion in the next financial year. By 2025/26, it will exceed the R6 trillion mark.

The cost, or interest of this debt, for next year alone, amounts to around R385.9 billion.

Over the MTEF, interest costs amount to R1.3 trillion.

ALSO READ: Driver’s licence: New vs old licence cards compared

MIDTERM BUDGET SPEECH SUMMARISED

ELECTRICITY

The Eskom Debt Relief Amendment Bill tabling this afternoon seeks to enhance the enforceability of the conditions agreed under the debt relief agreement.

It provides for the payment of interest by Eskom on amounts advanced as part of the debt relief loan.

The Amendment also provides for the reduction of the amount of debt relief available to Eskom, in the event that the entity does not comply with the National Treasury conditions.

ALSO READ: Coincidence? Boks win World Cup, Eskom implements load shedding hours later?

These principles and strict conditionalities, greatly enhanced by the Amendment, are a key part of how we will deal with Eskom and all other state-owned entities, to avoid a repeat of the mistakes of previous bailouts.

THE GOOD

Cash injection to a few departments in line with the public service wage agreement

- Government has made a strategic decision to allocate funds to sectors that are personnel heavy, such as Health, Education and Police Services. Additional funding of R24 billion this year and R74 billion over the medium term will be used to fund the 2023/24 wage increase and the associated carry-through costs in these sectors.

Extension of SRD Grant and allocation to disaster funds

- R34 billion is allocated to extend the Covid-19 Social Relief of Distress grant by another year.

- R1.6 billion is being made available for disaster relief, including to repair flood damage in various provinces.

ALSO READ: Eish! Grim outlook for Medium-Term Budget Policy Statement

THE BAD

Lower tax collections projected

- Tax revenue collection, is projected to fall short of 2023 Budget estimates by R56.8 billion in 2023/24 and R121.4 billion between 2024/25 and 2025/26.

Eskom debt relief

- 67 applications by municipalities had been submitted for Eskoms debt relief programme. They represent R56.8 billion or 97% of total municipal debt owed to Eskom at end-March 2023.

- Eskom debt relief amounting to R254 billion from 2023/24 to 2025/26.

LOGISTICS- TRANSNET FAILURE

- Rail underperformance is estimated to have cost up to 5 per cent of GDP in 20″22, with losses in the region of R50 billion in the minerals sector alone.

“No modern economy can thrive and grow new industries if rail lines are beset by delays, and ports are unable to efficiently handle incoming and outgoing cargo.”