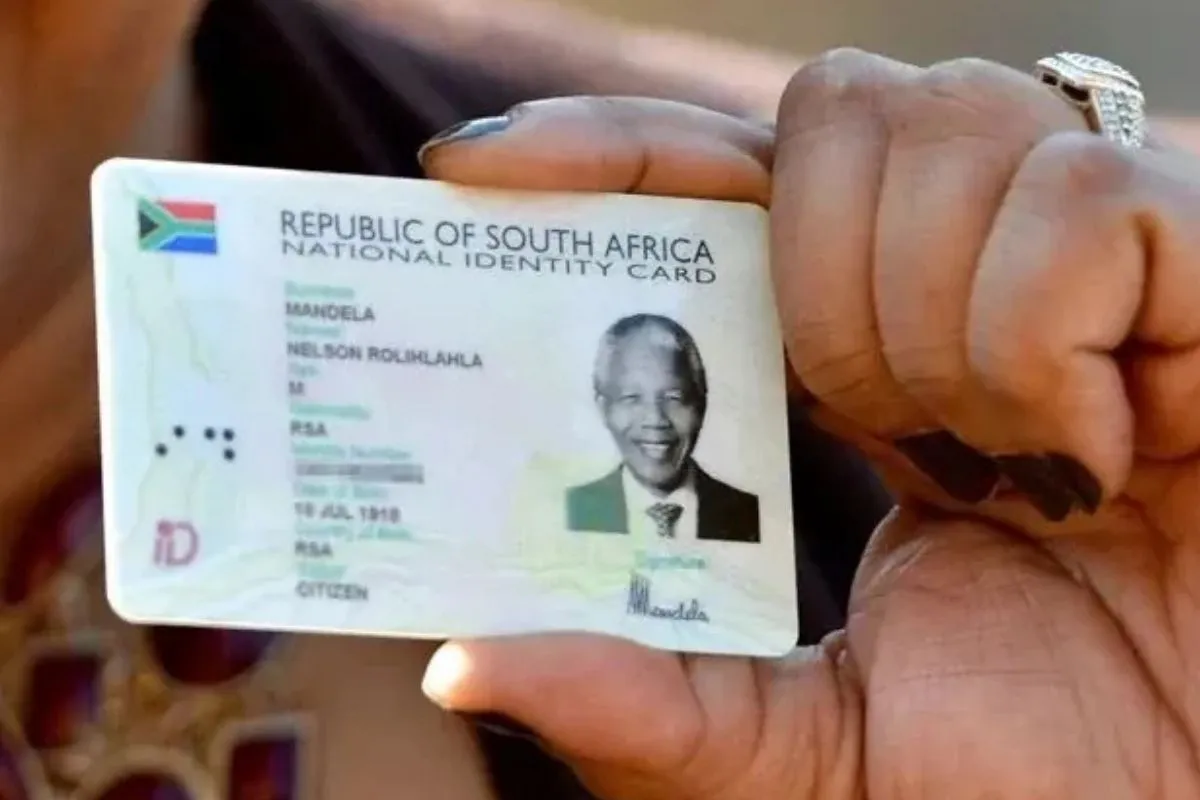

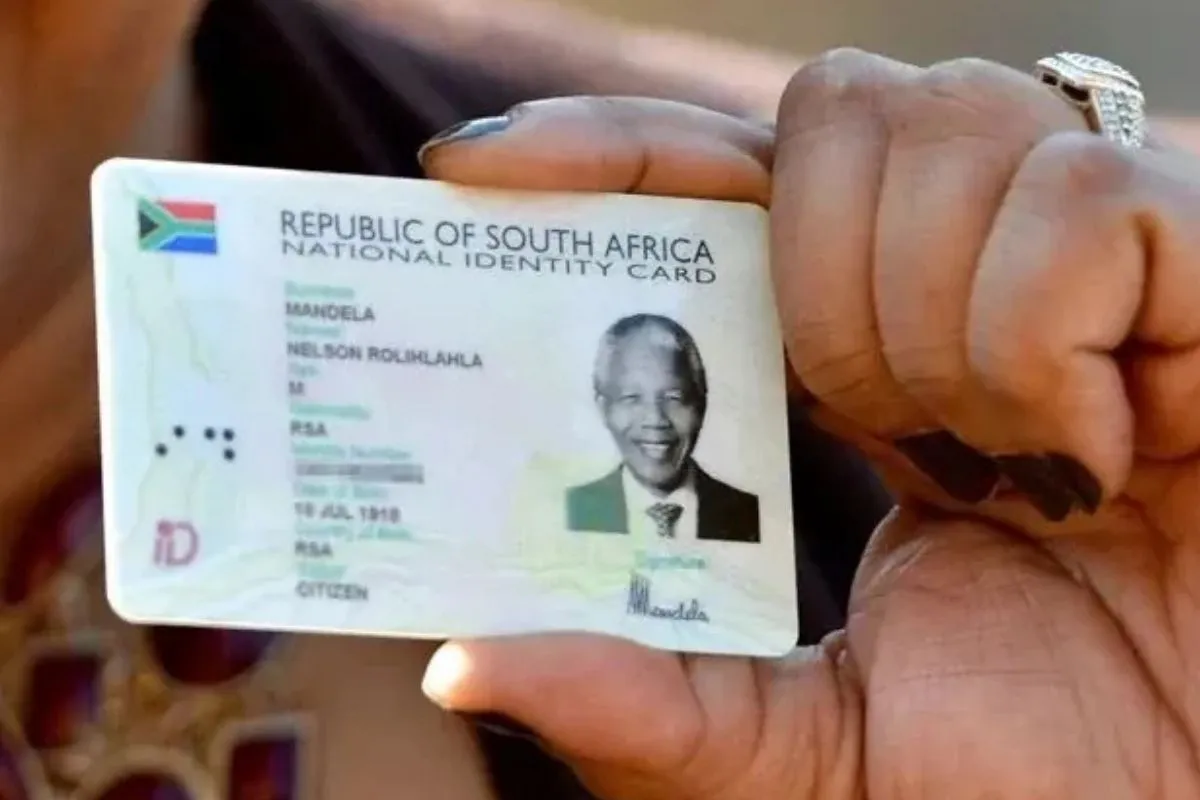

Banks set to change the process for applying for Smart IDs and passports

Major changes are coming to South African banks and the way citizens apply for Smart IDs and passports.

South Africans will soon be able to visit bank branches without an appointment to apply for smart IDs and passports.

This initiative is part of a new digital partnership between the Department of Home Affairs (DHA) and five major banks: Absa, Capitec, Discovery Bank, FNB, and Standard Bank.

FNB will lead the rollout.

No more appointments needed

FNB’s Points of Presence CEO, Zibu Nqala, recently told MyBroadband that the bank will expand smart ID and passport services to 240 branches over the next 12 months, starting with 15 high-demand locations, particularly in underserved communities.

Currently, seven FNB branches in Gauteng, the Western Cape, KwaZulu-Natal, and Limpopo already offer these services through the eHomeAffairs pilot program, which launched in 2015.

Under the new partnership, FNB will extend services to the Eastern Cape, Northern Cape, Free State, and Mpumalanga. Unlike the eHomeAffairs pilot, where DHA staff used department equipment inside bank branches, the new model will be driven by the banks themselves.

Citizens will no longer need to apply online, pay in advance, or book limited slots through the government website.

Instead, they will be able to walk into participating branches and complete the process directly with bank staff.

With this new rollout, South Africans will have hundreds of additional locations to apply for IDs and passports, and the freedom to do so without the inconvenience of pre-booking.