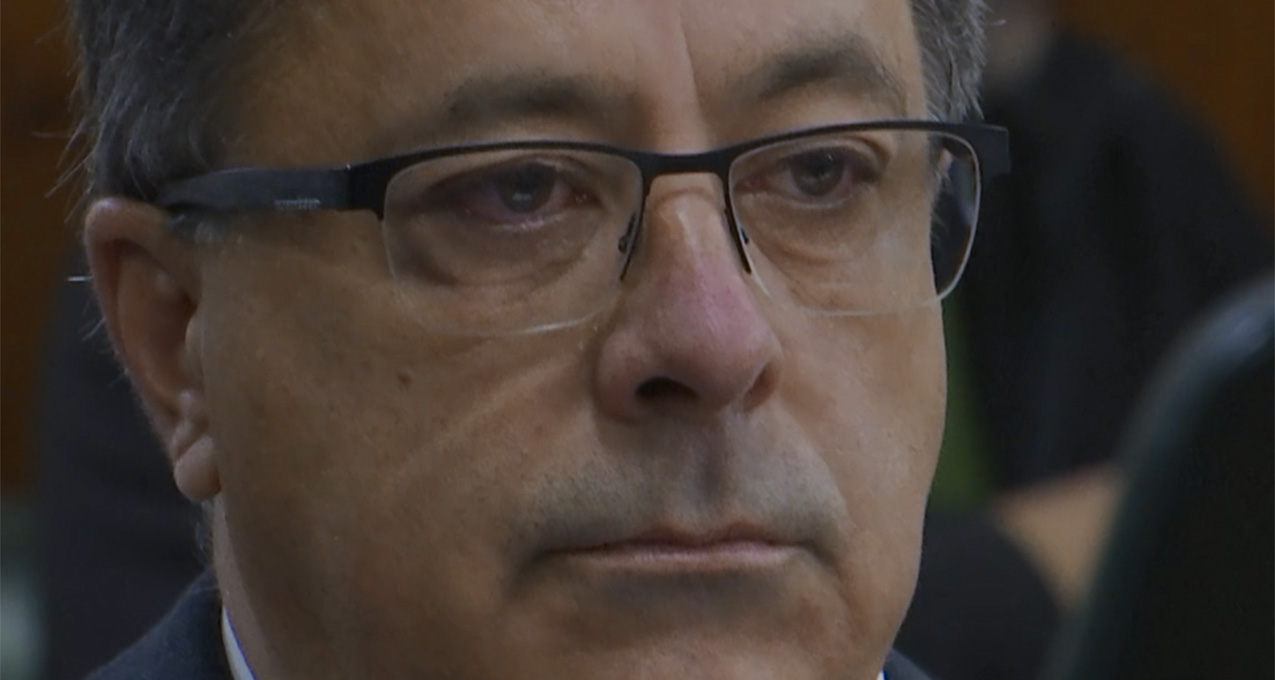

Markus Jooste’s death doesn’t impact R475M penalty

The Financial Sector Conduct Authority has confirmed that Markus Jooste’s death doesn’t nullify the R475 million penalty issued against him.

The Financial Sector Conduct Authority (FSCA) has confirmed that Markus Jooste’s death did not impact the R475 million penalty it issued.

The FSCA issued the disgraced former CEO an administrative penalty for contraventions of the Financial Markets Act (FMA) related to his reporting on the financial position of Steinhoff International. He reportedly committed suicide in Hermanus, Cape Town, on Thursday, 21 March.

FSCA INVESTIGATION ON STEINHOFF CONTINUES DESPITE MARKUS JOOSTE’S DEATH

The FSCA said the investigation relating to Steinhoff will continue as there are other investigated parties involved.

The Authority said it will also continue to assist the Hawks and the National Prosecuting Authority (NPA) with any investigations they may have underway.

“As the penalty on the late Mr Jooste in his personal capacity was already imposed at the time of his death, his passing does not impact on the penalty.

“The FSCA is legally entitled to recover the penalty from the estate of the late Mr Jooste. Whether the Authority will claim against the estate will be decided at the appropriate time, considering all the relevant circumstances.”

FORMER CEO SLAPPED WITH R475 MILLION PENALTY

Jooste’s death comes just a day after the FSCA issued him a penalty of R475 million.

The penalty was issued after a thorough investigation into Jooste and former Steinhoff legal head Dirk Schreiber.

The investigation found that the two made or published false, misleading, or deceptive statements about Steinhoff International Holdings Limited and Steinhoff International Holdings NV, which they knew or ought reasonably to have known were false, misleading, or deceptive.

“The FSCA found that by doing so, the two contravened sections 81(1)(a) and (b) of the Financial Markets Act, 19 of 2012 (the FMA). The findings relating to Mr Jooste and Mr Schreiber were made as part of an ongoing investigation by the FSCA.

“The Authority is continuing with further investigations into similar contraventions of section 81(1)(a) and (b) of the FMA by other individuals.”